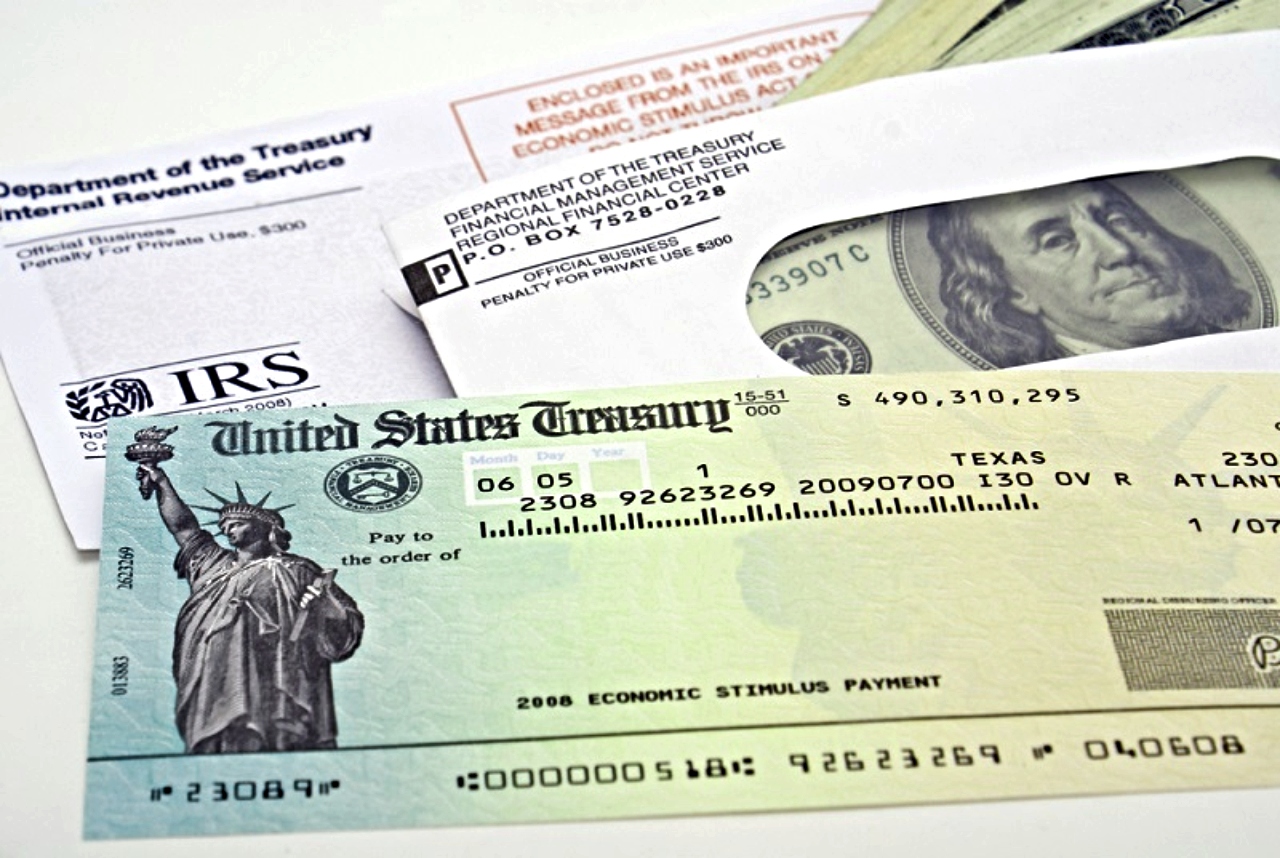

Oops! According to a recent tax audit, the IRS sent over $1 billion to the wrong people during the COVID pandemic in 2021.

A Big Mistake by the IRS

WND News reported that the Internal Revenue Service (IRS) sent over $1.1 billion in child tax credits to the incorrect recipients in 2021 during the pandemic.

An audit by the Department of the Treasury’s Inspector General (IG) for Tax Administration showed that the IRS sent payments to about 1.5 million people between July and November 2021 by mistake.

How Did This Happen?

According to the IRS, the errors were due to a problem in their computer systems that they corrected in 2021.

The audit states this is what the IRS did:

- Failed to send $3.7 billion to eligible households

- Sent 1.5 million taxpayer’s payments in error, some received 2 checks for 1 child

- Did not send payments to 4.1 million eligible households

- Incorrectly sent 6,829 reconciliation letters to taxpayers who got the credit

- Incorrectly changed 1,610 taxpayers’ bank account information used to receive direct deposits of the credit

The IRS agency was, however, 98% accurate in sending more than 175 million child tax credit payments.

The incorrect payments were made to taxpayers whose dependent children, required to claim the credit, did not meet the age requirements (under 18 years old), were claimed on another filer’s return, or were deceased. These incorrect payments made up a small portion of the 178.9 million child tax payments made during the period, totaling over $76 billion.

You can read the official report here.

In 2021, the mistake by the IRS was reported to the public. The video below states that around 13,000 checks were sent to the wrong bank account.

Do Recipients Have to Pay it Back?

As stated by the IRS, families who received the money in error must pay it back when they file their tax returns for the 2021 tax year.

Families eligible for the benefit but did not receive the child tax credit payment may request it be granted in the 2021 tax return. Some of these cases are taxpayers who used a taxpayer number rather than a social security number to identify themselves, which is the case of many undocumented migrants who were also eligible.

Get the news you need at It’s On News.

Well why didn’t they send me some of that? I could get my home heating oil tank filled for the winter. Oh it probably went to the wealthy people.